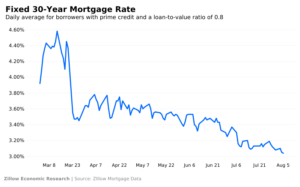

Recently, downward pressure on mortgage rates has been consistent, but a combination of factors — including increased demand from borrowers and reluctance from lenders to push rates lower – had kept them afloat. But the inability for the federal government to agree to a new fiscal relief bill last week finally tipped rates over the edge and down to new all-time lows. Now that the threshold has been broken, more downward rate movements may be on the horizon. Specifically, a weak July jobs report (due to be released on Friday) could indicate that the economy is struggling to recover amid rising coronavirus case counts.

This interpretation would most likely drive mortgage rates down even further, while better-than-expected news would place a modest, upward pressure on rates.